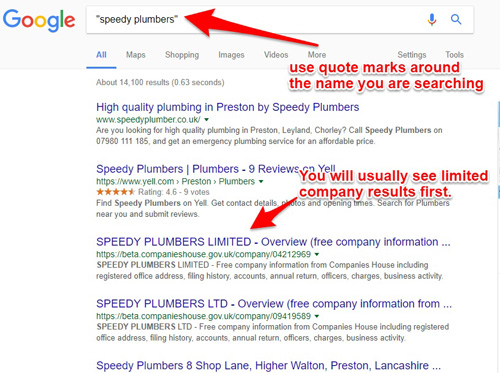

Companies House Uk Filing Deadlines

From today 25 march 2020 businesses will be able to apply for a 3 month extension for filing their accounts.

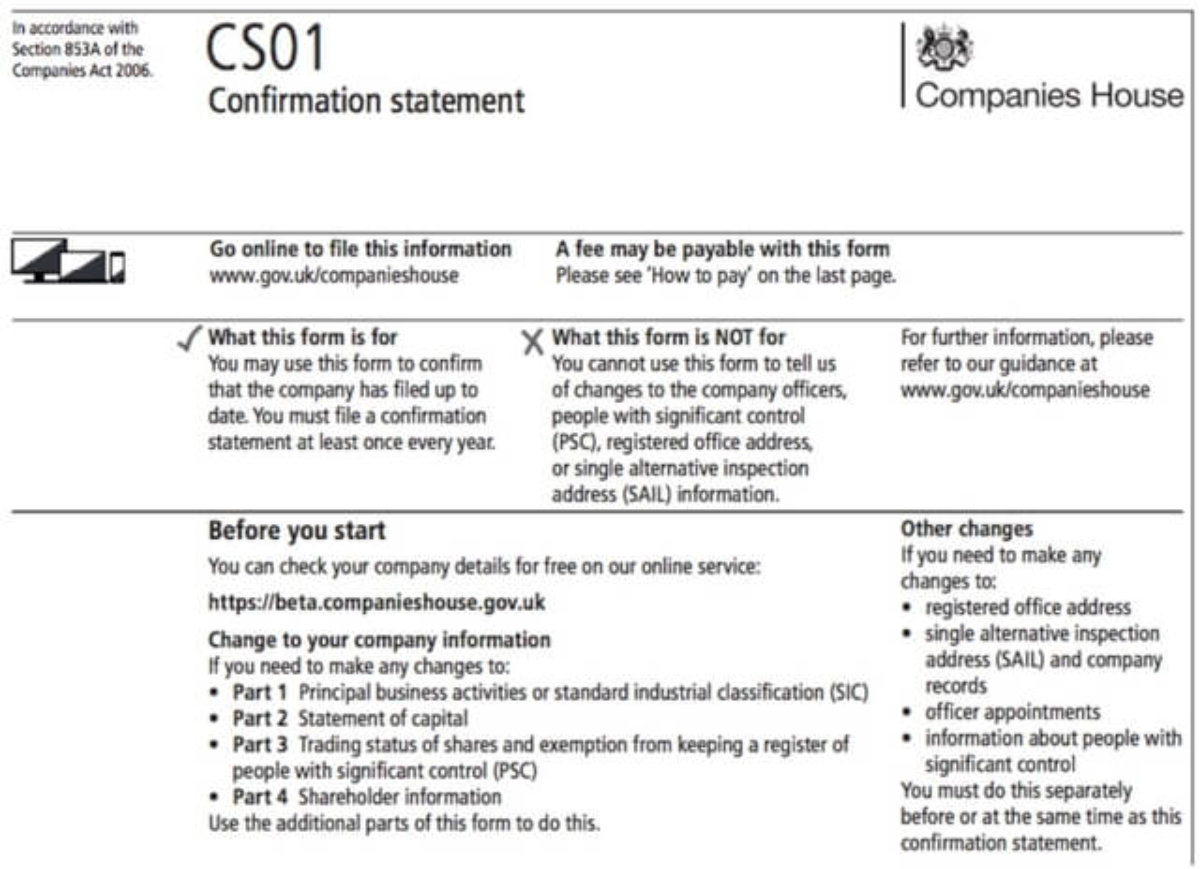

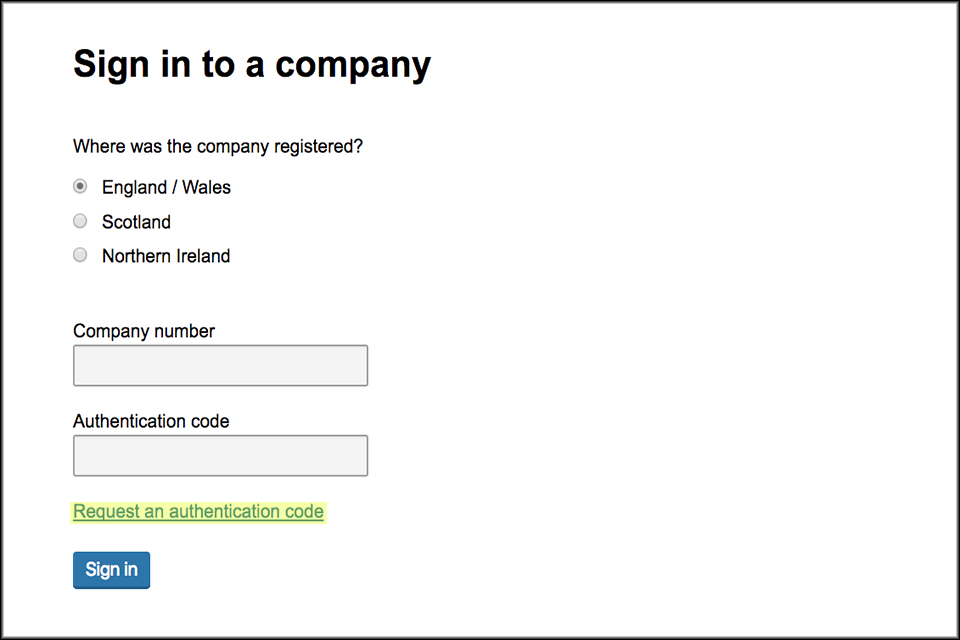

Companies house uk filing deadlines. 9 months from the accounting. Some of the measures in. If you re filing your company s first accounts and those accounts cover a period of more than 12 months your filing deadline will now be. Public limited companies plcs now need to file within 9 months.

Lucy fergusson corporate partner at linklaters said. Deadlines for filing accounts unless you are filing your company s first accounts see below the time normally allowed for delivering accounts to companies house is. It explains how an lfp will be imposed against a company if its accounts are not filed by the filing deadline. This joint initiative between the government and companies house will mean businesses.

Private companies and llps now have 12 months to file their accounts with companies house. Companies house has robust plans in place to maintain services for our customers and protect the welfare of our employees during the coronavirus outbreak. Previously the due date was 6 months after the year end. 21 months after the date you registered with companies house.

Coronavirus covid 19 on 25 june 2020 the corporate insolvency and governance act 2020 received royal assent. This guide applies to all private and public companies registered in the uk. 24 months from the date of the date of incorporation for. You must apply for the extension before your filing deadline.

File annual accounts with companies house. This is a temporary extension of 3 months from the normal filing deadline of 9 months after the year end. The frc s announcement states that companies will be granted potentially much needed leeway by an extension of the deadlines for filing. 9 months after your company s.

And 12 months from the end of the accounting period.