Companies House Beta Late Filing Penalty Payment

The penalty is doubled if your accounts are late 2 years in a row.

Companies house beta late filing penalty payment. The penalties will be doubled if a company files its accounts late in 2. I then ran through a demonstration of the prototype explaining where it s come from and what it looks like now. If they were not delivered to companies house until 15 july 2010 the company will incur a late filing penalty of 150. Your penalty occurred before 30 march 2020.

If the accounts are not filed to companies house by the deadline then the company may attract late filing penalties as follows. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online. It may take up to 30 minutes to complete this application. You ll have to pay penalties if you do not file your accounts with companies house by the deadline.

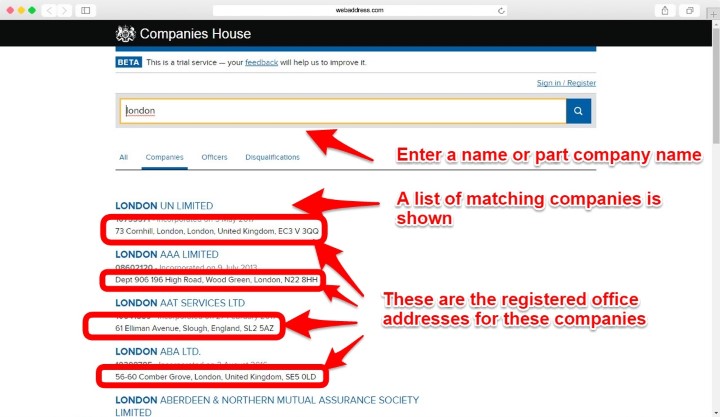

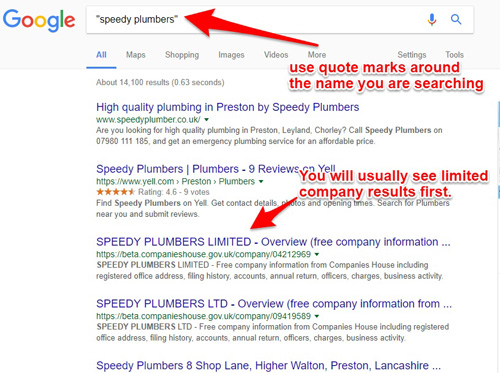

You will find a link to the online service on your penalty notice. Use this service to appeal a penalty issued to a company for not filing its annual accounts on time. If your late filing penalty occurred on or after 30 march 2020 you may be able to pay your late filing penalty online. Free company information from companies house including registered office address filing history accounts annual return officers charges business activity.

You should pay by bacs instead if. By debit or corporate credit card online. At your bank or building society. You will find a link to the online service on your penalty notice.

Under normal circumstances companies that file accounts late are issued with an automatic penalty. As part of the agreed measures while companies will still have to apply for the 3 month. Penalties for public limited companies are different. Online or telephone banking faster payments chaps.

Appeal a late filing penalty.